1. Introduction

In the times of crises, the policy of financial recovery becomes extremely important because the number of so-called problem banks increases, and it makes the banking system less sustainable as a whole. A sustainable development of the banking system is one of the most important goals of the Central Bank. That is why to reach this goal the Central Bank is forced to implement a policy of financial recovery towards such banks using the mechanisms of sanitation and liquidation.

Thus, the regulator has two options to deal with a troubled bank. Clear criteria for choosing a particular mechanism are not officially fixed. As practice shows, the Bank of Russia prefers sanitation when one or more of the following conditions is fulfilled:

- a credit institution plays an important role within the banking system;

- the financial position of the credit institution can be improved;

- expenses for insurance payments to depositors of a credit institution exceed the costs of sanitation.

2. Literature review

An analysis of the current state of research in the recovery of the national banking sector in Russia leads to the following conclusions.

Many reputable Russian scientists deal with the issues of the reorganization of the national banking system. A group of authors under the guidance of Professor O. Lavrushin presented the results of research in a scientific monograph [1]. On the basis of the theoretical and practical analysis, the structure of the national banking system is evaluated from the standpoint of increasing its efficiency. According to the authors, the modernization of the structure of the banking system of the Russian Federation will provide an opportunity to increase the role of banks in the economy, as well as improve the risk management system of the banking activities in conditions of turbulence in the development of credit institutions.

Features of the international and Russian practice of recovery of problem banks are considered in S. Andryushin’s and V. Kuznetsova’s article. On the basis of analyzing the dynamics and structure of liabilities and capital of Russian top-5 banks, the authors show that in the conditions of prolonged credit compression restructuring of the Russian banking sector is possible only through a voluntary reorganization mechanism. According to the authors, preventive compulsory reorganization will be perceived by the market as a signal of a possible bank insolvency, which could trigger the outflow of creditors (depositors) and provoke financial instability and additional contraction of the loan portfolio of the banking sector [2].

Some results of the activity of the Bank of Russia as a mega-regulator of the financial market are considered by representatives of St. Petersburg’s academic financial school of V. Krolivetskaya and I. Soldatenkova. The authors justify the necessity of transition to proportional regulation of the banking sector. They also propose options for the organization of differentiated supervision in accordance with the new organizational structure of the second level of the banking system [3].

Yu. Ezrokh analyzes the stages of the economic evolution of the institution of the reorganization of banks in Russia from its inception to the present. The article deals with describing the main advantages and disadvantages of the existing mechanisms of financial recovery, which predetermined the evolution of the institution of rehabilitation. The key shortcomings of the “credit” rehabilitation mechanism, which determined the transition to the modern stage of its evolution, are revealed in detail. Yu. Ezrokh believes that the Bank of Russia’s position on the reorganization of commercial banks is a significant factor in changing the structure of the domestic banking system [4; 5].

Despite the undoubted theoretical and practical significance of these studies, they did not sufficiently address the reasons for the ineffectiveness of the policy of the banking system financial recovery. The dependence of factors of capital and assets concentration and the profitability of banks is not investigated either.

3. Materials and methods

The authors have analyzed the statistics and mechanisms related to the rehabilitation of the Russian banking system.

The Central Bank rehabilitates large banks - 23 banks out of 29 sanitized credit institutions have assets in excess of 20 billion ruble as of 01.03.2018 and are in the top-200 largest credit institutions in Russia. As for small banks the Central Bank prefers to immediately revoke their licenses [10].

In 2013, the Central Bank began large de-licensing activity. From 2013 to 2017, it revoked licenses from almost 300 banking institutions. The peak of license revocation came in 2015 and 2016, when the Central Bank withdrew 93 and 97 banking licenses, respectively. As a result, the total number of banks decreased by a quarter. Meanwhile, the number of unprofitable organizations declined insignificantly and on March 1st 2018 accounted for 25% of the total number [7; 10].

In 2017 the number of license revocations dropped to 50. Probably, the reason was that large banks including the systemically significant Otkritie Bank from the top-10, faced serious financial problems. As a result, the Central Bank was forced to shift its attention to the mechanism of sanitation. From September 2017 to the end of the yaer, sanitation was announced in 5 banks. In addition, a new scheme of this mechanism was developed [10].

The previous rehabilitation mechanism was carried out through the Deposit Insurance Agency, which received loans from the Bank of Russia and then gave them on a competitive basis to the investor banks.

Within the new scheme, which was approved in mid-February 2017, the recovery is carried out by the Central bank itself by means of using the resources of the Banking Sector Consolidation Fund. The purpose of the recovery is to sell the bank to a private player.

4. Results and Discussion

The important advantage of the old scheme was that the recovery was carried out by a private investor.

However, this model has been criticized by the Central Bank. Not all investors use loans efficiently and some projects even have a negative effect on the financial situation of the investors themselves. The circumstance that the three banks that conducted sanitation soon faced serious financial problems themselves (these are the Otkritie, Binbank and Promsvyazbank banks), as well as the fact that at the beginning of 2017 only in 14 credit institutions out of 43 financial recovery procedures were completed confirmed the ineffectiveness of the previous scheme [6].

The new scheme has a number of advantages, such as the ability of the regulator to quickly remove the negative information background and stop the outflow of depositors. For example, after the Central Bank announcement about the introduction of an interim administration in the Otkritie Bank, the outflow of funds from legal entities slowed down more than three times, and the individuals stopped withdrawing their funds (for a month their volume increased by 1 billion rubles).

However, there are some drawbacks. Firstly, the concept of a new scheme assumes the transition of private banks to state ownership. That is why the state share in the banking sector will increase. At the beginning of 2018, this share was already about 70% compared to 41% in 2008 [7]. The predominance of state ownership in the banking sector on the one hand makes the system more reliable, on the other, it becomes less flexible and more vulnerable to future crises.

Secondly, the monopolization of the banking sector will continue. In 2017, the profit of the banking sector decreased by 15%. However, 85% of this indicator (674 billion rubles) was the net profit of Sberbank, which increased by 30%. The profit of VTB amounted to 104 billion rubles. Compared to the previous year, this figure has almost doubled [7]. This confirms the fact that the largest state banks have an advantage due to the current policy of financial recovery. If, apart from Sberbank and VTB Group, the third state banking group of those which are now rehabilitated by the Central Bank appears in Russia, small private banks will not be competitive.

Thirdly, the high costs of recovery. In particular, the Central Bank spent 456 billion rubles on the capitalization of the Otkritie Bank and this amount has been growing in 2018. Besides, it will be troublesome to compensate these costs by selling the stake of the Central Bank to private players. It will be extremely difficult to find a buyer for such giant problem banks in the foreseeable future.

Considering the results of the current policy of financial recovery, it is possible to identify some trends.

The most evident is an increase in the concentration of assets and capital in the banking sector. According to the Central Bank, at the beginning of 2018 the share of assets of the five largest Russian banks in the assets of the entire banking system was 56% [10]. This is the result of a large-scale recovery of licenses.

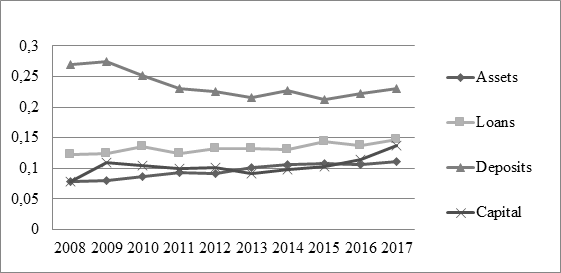

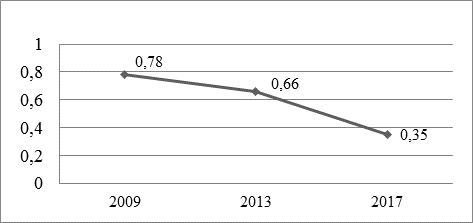

The consequence of the increase in the concentration was the strengthening of monopolization in the banking sector. This is evidenced by both an increase in the Herfindahl-Hirschman index and the dynamics of the more recent indicator, H-statistics of Panzar-Rosse, according to which the banking sector being in a state of monopolistic competition is getting closer to the monopoly (see Pic. 1,2) [10; 8].

Pic. 1: Herfindahl-Hirshman index

Pic. 2: H-statistics of Panzar-Rosse

Despite the fact that there are two points of view on this issue, most researchers confirm the inverse relationship between the decline in competition and stability in relation to the Russian banking sector [8; 9].

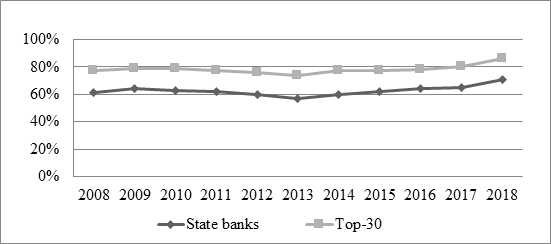

Another result was the lack of a stable growth of profit in the banking sector. Despite the significant growth in 2016, in 2017 the financial result of the banking sector fell by 15%. In addition, the profit is distributed unevenly as a result of the transfer of deposits to large state-owned banks. The share of the state banks in the deposit market for 2018 is 71%, the share of top 30 banks is 86%, compared to 61% and 77% respectively in 2008 (see Pic. 3) [10]. Because of the increased risk of bankruptcy of private banks, people prefer to place deposits in more reliable large state-owned banks, so they get a much larger profit.

Pic. 3: Share of the banking group on the deposit market

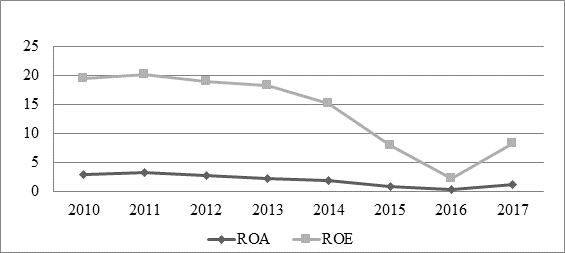

Finally, there is a decrease in the return on assets and capital. In case of assets it decreased almost twice during the period under review (see Pic. 4) [10].

Pic. 4: Return on banks’ assets and equity

Obviously, these trends also have a negative impact on sustainability. It is accompanied by a large volume of uncompensated costs of recovery (about 3 trillion rubles) [8].

5. Conclusion

Basing on the obtained results it can be concluded that the policy of the Central Bank on financial recovery of the banking sector has not made it more sustainable. Consequently, the goal of the Bank of Russia policy has not been achieved. Thus, this policy cannot be considered effective.

We identify the following reasons for the inefficiency of the financial recovery policy.

1. Low transparency; (in particular, clear criteria for choosing a particular mechanism are not officially fixed.)

2. Recovery through nationalization;

3. Concentration on direct financing;

4. Insufficient monitoring and supervision; (problems are most often detected at a late stage) [7].

Thus, we can suggest the following solutions.

1. Legislating the criteria for the choice of a mechanism of financial recovery;

2. Using alternative sanitation schemes taking account of the experience of foreign countries, in particular;

3. Using indirect support measures;

4. Closer monitoring and supervision;

The Central Bank of Russia has recently paid much attention to this measure. According to experts, the volume of hidden "holes" in the capital of banks has significantly decreased. In order to improve the situation it is necessary to develop other areas too.

Библиографическая ссылка

Вышковская М.П., Ильницкая Т.О., Юманова Н.Н. ПОЛИТИКА БАНКА РОССИИ ПО ФИНАНСОВОМУ ОЗДОРОВЛЕНИЮ БАНКОВСКОГО СЕКТОРА: АСПЕКТЫ САНАЦИИ И ЛИКВИДАЦИИ // European Student Scientific Journal. 2018. № 6. ;URL: https://sjes.esrae.ru/ru/article/view?id=454 (дата обращения: 18.11.2025).